The organic market grew two per cent last year to now be worth £3.2bn but a call has been issued for a radical rethink over how UK farmers can reap the benefits.

Soil Association Certification has launched the 25th Organic Market Report 2024 sponsored by RBOrganic, which revealed that the organic food and drink market has delivered its 12th year of positive growth, despite the global political and economic turmoil and the cost-of-living crisis. The total market grew two per cent in 2023, ending the year at £3.2bn– almost double its value in 2011. Independent retail was buoyant, with sales rising 10 per cent to £475m.

Speaking today at the launch of the report, Alex Cullen, Soil Association Certification Commercial Director (pictured), explained that certain areas that had fallen back slightly bounced back from last year, including supermarkets and independent retail: “Independents I know for many of you will be a really important player in your overall performance. The channel is now worth nearly half a billion pounds, and we are seeing two thirds of respondents to our survey seeing growth and anticipating growth next year so it really has bounced back. The beauty of independents is that speed and agility and ability to operate locally and really connect with customer base locally.”

Looking at the report more generally, Alex went on: “We have seen the cost-of-living crisis take a hit in a couple of specific areas. One is home delivery, where we have seen people cut back on what they might see as discretionary spending, and also beauty and wellbeing has fallen back for the first time this year. Having said that, there is also a strong level of confidence we are seeing from businesses in both those parts of the market. That really reflects where we are seeing broader shopper confidence start to bounce back, this is data from IGD. It’s been a pretty volatile time but where we have nutted out at the end of December 2023, we have actually seen that confidence climb back up 13 percentage points in the last 12 months. We are not out of the woods yet, and yes, there is still an awful lot of headline news that certainly takes its toll on people’s outlook on the world. But equally in terms of people’s individual household resilience and that feeling they have a bit of cash in their pocket, that is starting to come back.”

However, despite this solid performance, the sector’s heavy reliance on imports means many farmers are missing out on the potential benefits organic can bring to their business – and the UK environment in turn is missing the benefits organic can bring for nature. Shopper spend on organic is a third higher versus five years ago, but UK organic farmland has stayed at a static three per cent.

Alex went on: “Organic has delivered a positive and resilient performance despite challenging financial and political conditions and without the support that organic food and farming receives in Europe and elsewhere in the world. The market and macro trends are pointing to an upward trajectory but there are still many challenges and barriers to the level of growth that UK organic should be delivering for farmers – with price the biggest barrier.

“We need a radical rethink if organic is going to reach its full potential and bring organic farming into the mainstream. The entire supply chain must work together to grow the market and unlock demand for homegrown UK organic fresh produce, supported by the government. And we can learn valuable lessons from Europe, where there is greater support and commitment from governments and retailers for farmers and from some exciting innovations taking place right here across the UK – to make organic more available and affordable.”

Continuing at the launch webinar, Alex added: “We know organic is the most trusted and sustainable practice on the table at the moment. So, something has to give in this equation and the big theme touched on by Nielsen at our trade conference in November is this piece around price, and how can we find a way to start to break down this price premium that shows up for organic and holds us back from scaling the market and transforming our agricultural land.”

In terms of further detail of the report, organic supermarket sales returned to growth after a dip in 2022, now worth £2bn, while food service, which saw exceptional growth in 2022 of 156 per cent, remained stable in 2023. Online is continuing to be a strong performer – 22 per cent of all supermarket organic sales are made through this channel.

“We saw a strong overtrade from Sainsbury’s, the market leader, and Ocado punching well above their weight. We are seeing dynamism in this space. 2023 saw further shifts in supermarket performance, with Lidl up 0.3 per cent. They are coming from an under-trade point of view, but we have seen successive growth for a little while now. We see an over index of organic online, it is twice as likely to be bought online as it is in store and really speaks to the strength of the online customer profile and also the way that user experience can punch above its weight,” Alex commented.

Organic also saw encouraging growth on Amazon with products certified to Soil Association standards enjoying a 10 per cent sales boost. Organic certified beauty and wellbeing is now worth £136m, with a decline of eight per cent, although there were positive successes, such as mother and baby care, which grew 65 per cent. Organic certified textiles saw sales grow eight per cent to £100, and health and personal care grew by six per cent.

Looking at what people are buying, sales of organic fresh produce slipped in supermarkets as retailers have price-matched Aldi on conventional lines. This appears to have exaggerated the price premium on organic products, making them look more expensive to customers. The report added that farmgate prices for organic should attract a modest premium to reflect the high environmental and animal welfare standards required by organic assurance. However, new information comparing the farmgate premium to the price customers pay in the supermarket for organic suggests some premiums being charged by retailers are significantly out of kilter and warrants closer scrutiny. Supermarket pricing in other markets including many EU countries have reduced the relative premium and unlocked growth in core organic lines, highlighting an opportunity for UK retailers to make organic more affordable for shoppers.

Cullen added: “Food is not a particularly profitable sector, the recent Competition and Markets Authority investigations have been clear. Of course, every player in the supply chain needs to make a profit but when price is the biggest barrier to scaling the most sustainable and trustworthy farming system we have, there need to be more questions about what it would take to achieve economies of scale. We are undertaking thorough research to understand fully what is happening and how this is impacting organic sales. We are committed to collaborating with the supermarkets to share and develop this kind of innovation as we come out of the cost-of-living crisis. A rebalancing of the price and availability of organic foods will drive further strong demand and unlock the benefits for people, nature and the planet.”

Focusing on the independent side of organic, Unicorn Grocery, a worker-owned co-op in Manchester, cut prices on everyday organic essentials and explicitly compared RRPs to the supermarkets to highlight value (pictured).

Alex told the report launch webinar: “To ensure price isn’t a barrier to growth, they have taken a proactive approach of benchmarking their big organic lines, comparing how value for money they are. They have seen a really strong uptick, particularly a younger customer and a repeat customer. This has acted as a real halo to bring in footfall and drive wider sales across their store base.”

Unicorn Grocery Director, Dan Monks, added: “We want everyone, regardless of income, to have access to staples like onions, carrots and potatoes. We price-check against supermarkets so our customers know that organic is affordable, and to shed perceptions around high costs – we’re often the cheaper option. We can do this because we buy direct from farmers and growers, working with them to plan what they grow for the year. This has allowed us to invest in local farms, securing nature-friendly farming for the future.”

Looking in greater detail at organic farmland, the amount of UK organic land grew by 0.4 per cent, remaining flat at three per pent – despite a growing organic market. This compares with Europe, where the latest figures show that organic farmland grew by 5.1 per cent to 16.9m hectares or 10.4 per cent of total farmland in 2022.

RBOrganic, based in North Norfolk, is a specialist organic root vegetable business, part of the Burgess Farm Group, growing and supplying some of their organic carrots and potatoes. Joe Rolfe, Managing Director of Burgess Farms, commented: “The organic market in 2022 was tough due to inflation and the cost-of-living crisis but in 2023, organic sales returned to a more positive trajectory and are heading in the right direction. The price of organic vegetables are often seen as a barrier for customers but conventional equivalents are priced very cheaply, often below the cost of production. A challenge and opportunity for the sector going forward is how we bridge the gap between organic and non-organic. Our British Organic Carrots Growers Group has helped us achieve scale in organic vegetables and make them more available to the masses. This collaboration has enabled us to make efficiencies across the supply chain, share knowledge and drive innovation across our farms, whilst keeping us honest and working hard! Organic growers need to be rewarded with fair prices and supported by effective environmental schemes that balance environmental outcomes with food production.”

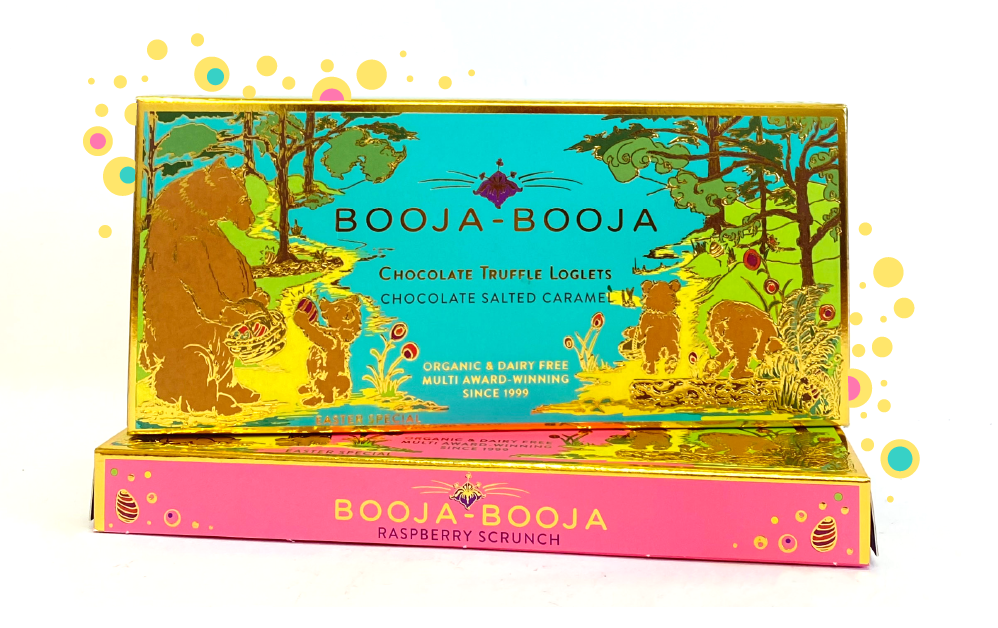

Award-winning chocolatier Booja-Booja is launching two new gift ranges in stunning, hand-designed packaging.

The company are introducing new heart-shaped gift boxes to their Artist’s Collection range, plus two new limited-edition Chocolate Truffle Loglets for Easter.

Heart-shaped gift boxes

The new heart-shaped gift boxes are handmade and painted in Kashmir, India, by the same community of artists Booja-Booja has been working with for 21 years. Each one is finished with a hand-tied ribbon to create an exceptional gift for chocolate lovers. Available in two flavours, Chocolate Salted Caramel and Fine de Champagne, the gift boxes each contain 12 heart-shaped chocolate truffles, made with smooth, organic dark chocolate and dusted in cocoa powder. Designed to be treasured as a keepsake long after the chocolates inside have been enjoyed, the heart-shaped gift boxes are part of the Booja-Booja Artist’s Collection and will be available all year round.

Easter special truffle loglets

New for Easter 2024 are two boxes of Chocolate Truffle Loglets presented in stunning, hand-illustrated boxes. Especially long truffles, rolled in dark chocolate flakes, Booja-Booja Chocolate Truffle Loglets were first introduced in autumn 2023 as part of a new gifting range and immediately proved extremely popular with consumers. The boxes for the new Easter Edition Truffle Loglets feature a playful seasonal illustration by Norfolk artist Pippa Mulvany. Embellished with gold foiling the boxes are exquisitely eye-catching and designed to make a deliciously joyful gift. Available for a limited season only, the Easter Edition Truffle Loglets are available in two flavours; fruity, crunchy Raspberry Scrunch and chewy, moreish Chocolate Salted Caramel.

Booja-Booja has been making dairy free, organic chocolate truffles in Norfolk since 1999 and its chocolate truffles are available from more than two thousand stockists throughout the UK, including independent wholefood stores, fine food shops, delis and selected supermarkets. The new heart-shaped boxes and Easter Special Chocolate Truffle Loglets are available from the company’s usual wholesale partners.

All Booja-Booja products are vegan, dairy free, gluten free, soya free and organic. Celebrated for its delicious, melt-in-the-mouth treats, Booja-Booja has won 180 awards and is recognised as one of the leading vegan and free-from confectionery brands in the UK.

Suma Wholefoods has announced that it is launching a new range of organic pestos, ready for spring. The range will launch with two products, one a green basil pesto and the other a red sun-dried tomato pesto, both of which are vegan and authentically Italian.

Suma, specialists in wholefoods and plant-based alternatives, offer a wide range of Italian products, from pasta and sauces to tomatoes and oils, all sourced fairly from the finest growers and producers.

Kate Willis, Brand Co-ordinator at Suma, commented: “Due to supply issues we couldn’t continue with our existing Italian pesto range. This left us with the challenge of sourcing a new range. We were looking for authentically produced Italian pesto and were really lucky to find some which are made in the Genoese area of Italy.

“We think customers will enjoy our new pestos as much as we do. We are really excited about the range and hopefully will bring some more new and existing additions soon.

“These pestos are good to have in stock, they’re ambient products, with a long shelf-life, and in recyclable packaging. And a great price too.”

Kate added: “Did you know pesto comes from the Italian word ‘pestare’ which means ‘to pound’ or ‘to grind’? It’s also where we get the word ‘pestle’, as in pestle and mortar. Who knew?”

Pesto is versatile store cupboard staple, perfect stirred through pasta or added to a sandwich for a quick, tasty meal, and can also be used as a multipurpose condiment – stir it through roasted veg, add a dollop to soups, drizzle on salads and pop on a jacket potato for an extra taste kick.

Available to order from www.wholesale.suma.coop from 1st March 2024.